A question which is often asked is ‘How good will a novel water treatment technology be as an investment proposition? And how long will it take before I get my money back!? Over the years, I have developed a comprehensive consolidated reference list of UF and MF installations to explore the membrane water market as discussed in my ‘Lessons of History’ blog three months ago. Fortuitously, this data turns out to be a useful tool to address these questions. Normally, people are only interested in the most recent data to predict future sales and market growth. However, I am pleased to say that the historic data has finally turned out to be useful in shining a spotlight on those early years of UF market development.

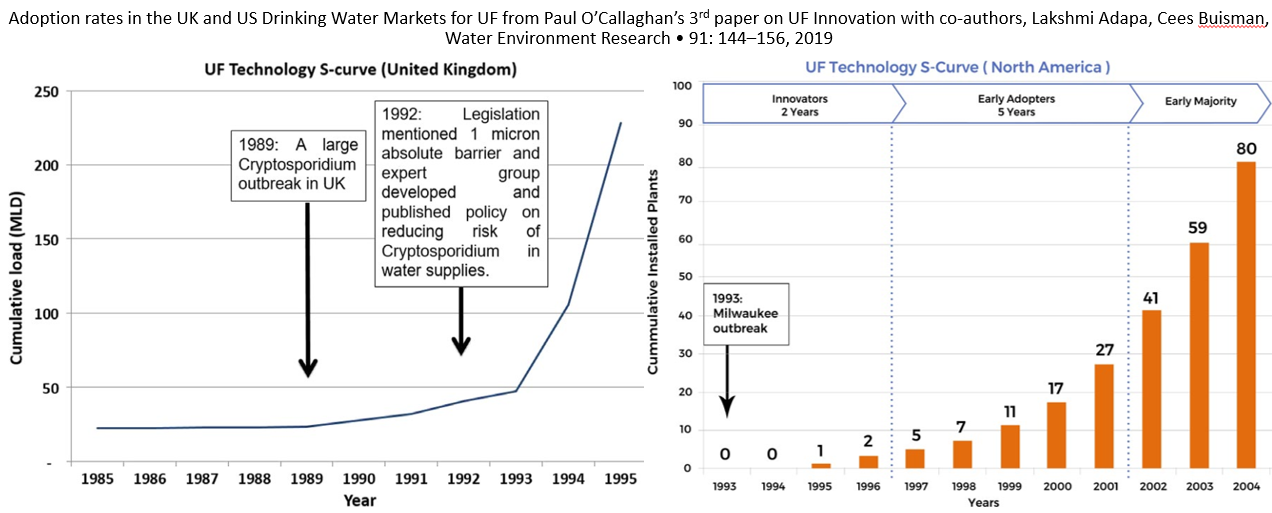

Paul O’Callaghan at BlueTech Research has written a PhD thesis on Innovation in the Water Industry and has been using data from my UF reference list analysis. Some of the findings from the thesis have also been published in a series of papers. In his thesis, Paul examines the rate of uptake of new technologies. He identifies three levels of uptake, and his proposition is that it takes 17-24 years for a technology to reach the 3rd level and become fully established as a substantial business (‘Early Maturity’ in market analysis language). The rate of adoption of UF has been interesting. First there was a slow burn while it started to become accepted, followed by a period of exponential growth as the industry drivers started to get teeth.

The reference list information that I have provided to Paul enables an analysis that goes back to the very start of the market in 1985, thus creating the perfect database for this study. Intriguingly, it gives a commentary on the rate of UF adoption, and the nature of that uptake. While some metrics have followed the predicted pattern, others have diverged. For example, the expansion of the UF market in terms of the number of references has mirrored other water technology developments. Conversely, other parameters such as how quickly the technology has spread and how rapidly the market has grown have developed at a different pace for UF. Paul will be defending his thesis at Leeuwarden in the Netherlands on 9th December and I will be a guest panellist as an industry practitioner. The type of analysis that Paul has done allows UF to be compared with other innovative developments in the water market and contrasts the impact that these technologies have had. The importance of the analysis to the business world is that it gives a realistic timeline for investors and gives an idea of the sort of return that could potentially be gained by the next star performer. From my perspective, what started out as a personal project of consolidating historical reference lists has turned into a useful tool in understanding the nature of innovation in the water market and the impact achieved by UF.